wyoming tax rate for corporations

Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. Wyoming does not have an individual income tax.

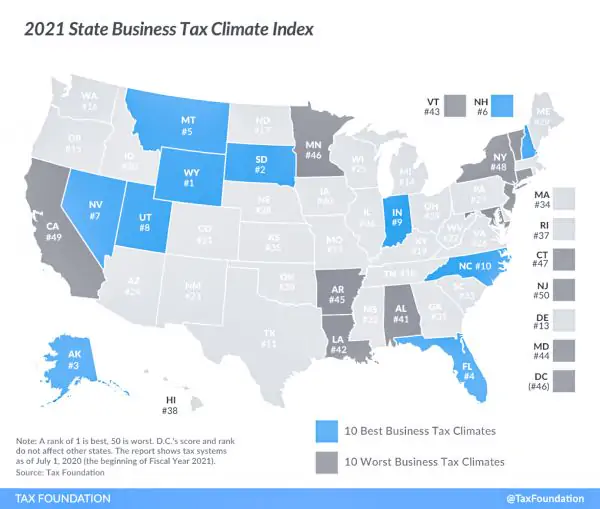

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200.

. 327 to have us form the Wyoming LLC for you. 1 day agoThe Center Square Georgia ranks among the best states for its combined federal and state corporate income tax rates a new analysis found. This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state.

Cheyenne WY 82002-0110. Herschler Building 2nd Floor West. This fee is levied against the in-state assets of limited partnerships LLCs and corporations doing business in the state.

A Wyoming LLC also has to file an annual report with the secretary of state. An S-Corp is a pass-through entity and so the earnings are not taxed twice. Wyomings license fee amounts to 0002 for every dollar of in-state.

So your initial costs. Address Lookup for Jurisdictions and Sales Tax Rate. The 2022 state personal income tax brackets.

Wyoming also does not have a corporate income tax. Registering for Wyoming Business Taxes Online. Before the official 2022 Wyoming income tax rates are released provisional 2022 tax rates are based on Wyomings 2021 income tax brackets.

That means the company does not pay taxes at the company level only the owners shareholders or. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. 1000 or so to talk to your CPA.

If you use Northwest Registered Agent as your. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax. Please note new mailing address as we.

Wyoming Department of Revenue Website. According to the Tax. Wyoming Internet Filing System.

Wyomings proposed corporate income tax only falls on a few select industry sectors at least initially but its a foot in the door for a broader corporate taxsomething. 7500 25 Of the amount over 50000. On top of that rate counties in Wyoming collect local sales taxes of up to.

Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report. Get a quote from. Wyomings license fee amounts to 0002 for every dollar of in.

13750 34 Of the amount over 75000. Wyoming Department of Revenue. 1000 or so to talk to your local lawyer.

The annual report fee is based on assets located in Wyoming. Wyoming Department of Revenue. The tax is either 60 minimum or 0002 per.

1 day agoState sales and use taxes currently at 4 would drop to 25 under Browns plan but Wyoming would reinstate its grocery tax and add taxes to services such as lawn care and. Corporate rates which most often are flat regardless of the amount of income. Wyoming also does not have a corporate income tax.

Marginal Corporate Income Tax Rate. Wyoming does not have an individual income tax.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

The 2017 Tax Attitude Where Does Your State Stand Infographic Signature Analytics

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Corporate Income Tax Rates By State Discover The Rates For All 50 States

Top States For Business 2022 Wyoming

Wyoming State Economic Profile Rich States Poor States

Corporate Income Tax Rates U S By State 2022 Statista

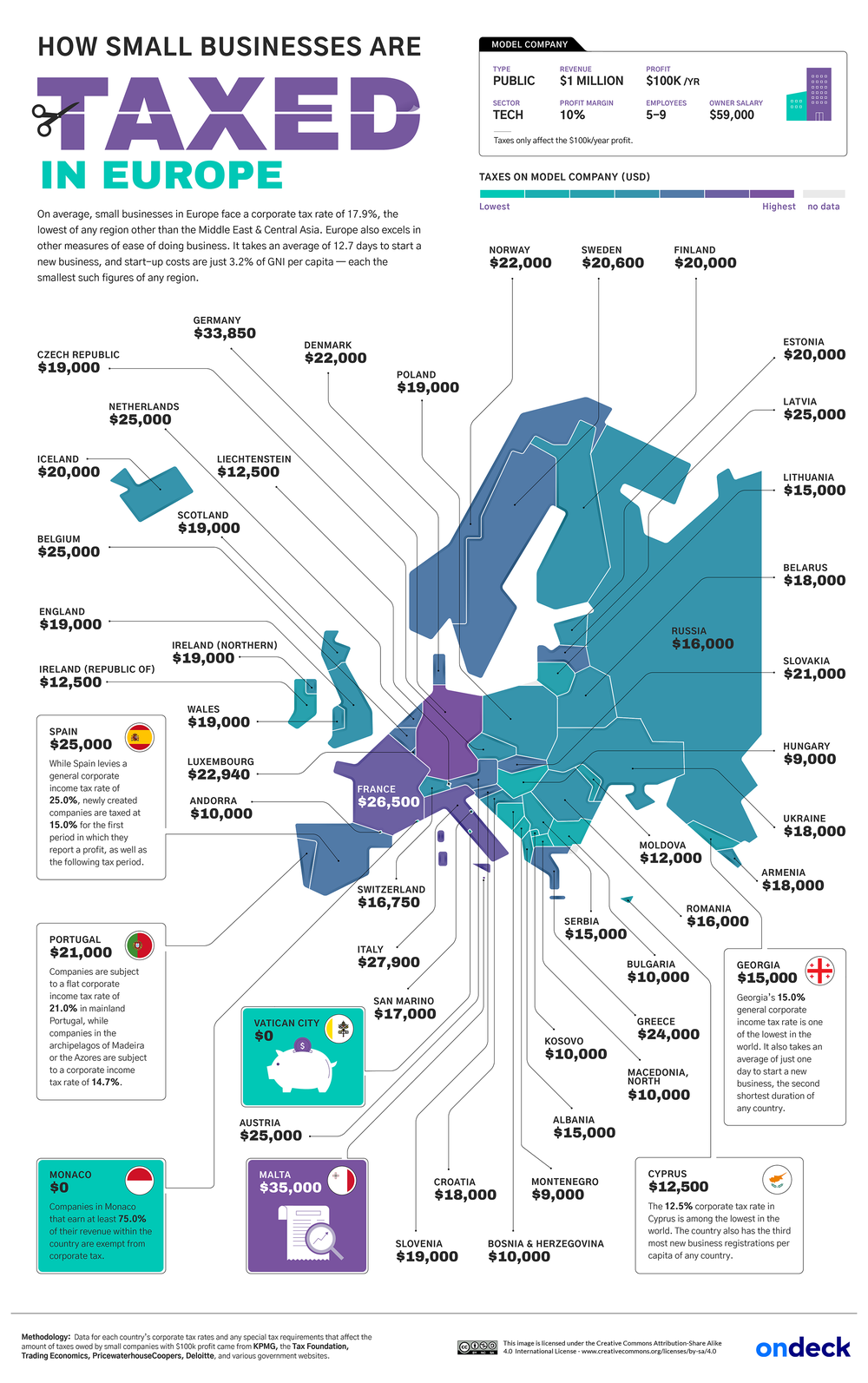

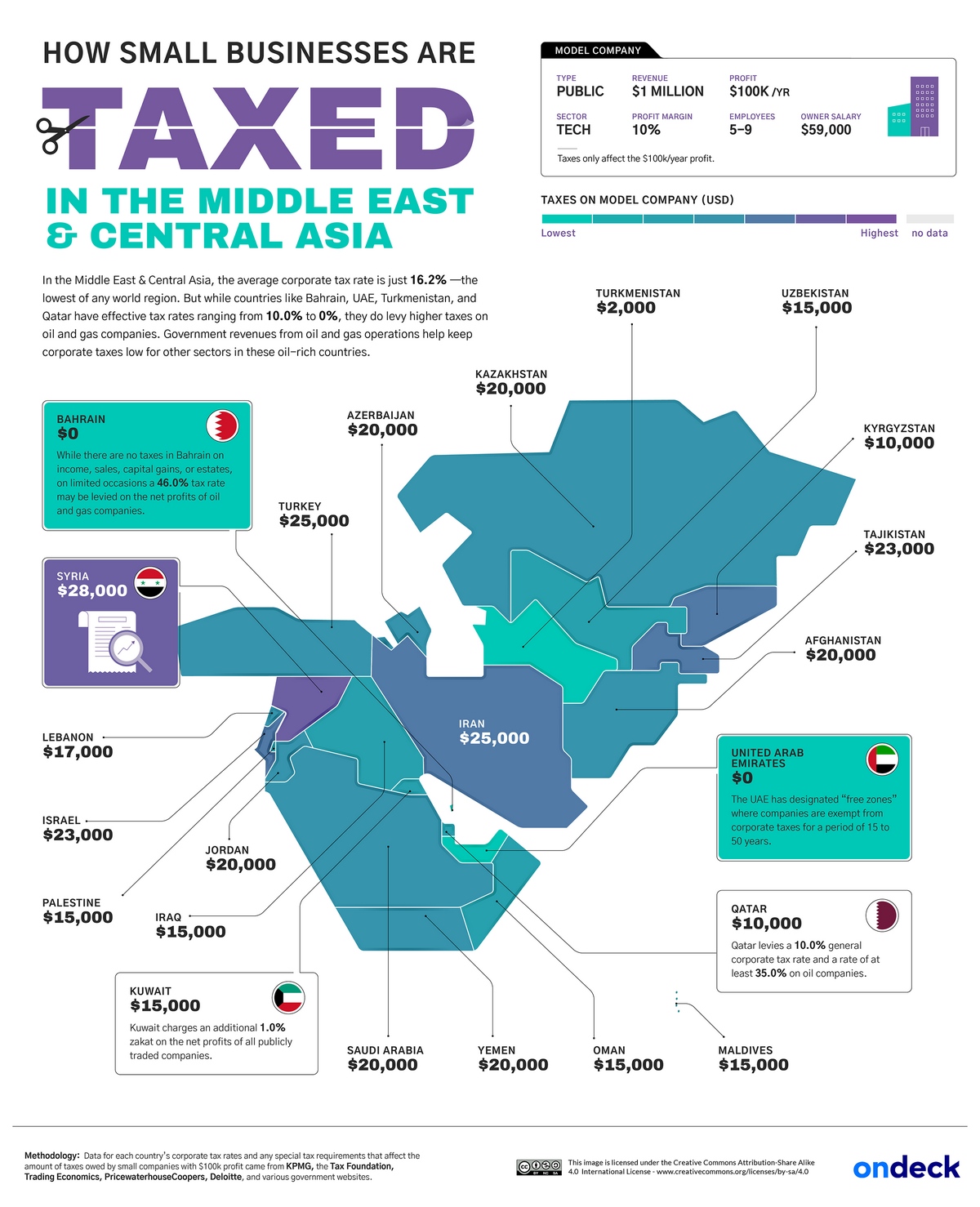

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

State Corporate Income Tax Rates And Brackets For 2020

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

_0.png)

Map Share Of State Tax Revenues From Corporate Income Tax Tax Foundation

Impacts Of The 2017 Tax Act On Business Valuation Valuation Research

Comparison Of Corporate Income Tax And A Download Table

A Corporate Income Tax In Wyoming Legislation That Would Enact It Is Moving Forward 307 Politics Trib Com

/TermDefinitions_Incometax_finalv1-2c3f527bde3a41c296b6389fda05101d.png)